PH BIR Form 0613 2004-2025 free printable template

Show details

Notes The following violations are not qualified for compromise penalties a. How to Accomplish the Form b. Indicate the amount of penalty for each violation listed in the prescribed letter from the concerned BIR Office. To be filled up the BIR DLN PSIC PSOC Payment Form Republika ng Pilipinas Kagawaran ng Pananalapi Kawanihan ng Rentas Internas BIR Form No. Under Tax Compliance Verification Drive/Tax Mapping December 2004 Fill in all applicable spaces. Indicate the amount of penalty for each...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1609 bir form

Edit your 1619 e bir form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 1619e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 0619 e forms online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit bir form 0619 e download excel. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bir 0619e form

How to fill out PH BIR Form 0613

01

Obtain a copy of PH BIR Form 0613.

02

Fill in your Taxpayer Identification Number (TIN) on the form.

03

Provide your name and address in the designated fields.

04

Indicate the tax type by selecting the appropriate option.

05

Enter the necessary payment details, including due dates and any penalties, if applicable.

06

Review the completed form for accuracy.

07

Sign and date the form before submission.

Who needs PH BIR Form 0613?

01

Individuals or entities required to report taxes in the Philippines.

02

Taxpayers who have transactions that are subject to withholding tax.

03

Businesses and self-employed individuals who need to comply with tax regulations.

Fill

0619 e form download excel

: Try Risk Free

What is 0613 bir form?

0613 Payment Form - Under Tax Compliance Verification Drive/Tax Mapping. This BIR form shall be used in paying penalties assessed under the Tax Compliance Verification Drive/Tax Mapping.

People Also Ask about bir form 0619 e excel

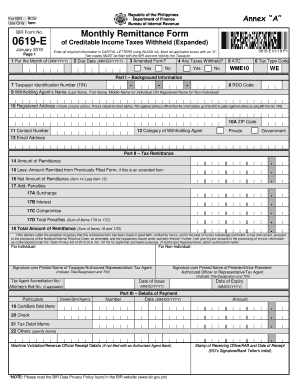

What is the purpose of BIR form 0619-E?

0619E - Guidelines and Instructions. This withholding tax remittance form shall be filed in triplicate by every withholding agent (WA)/payor required to deduct and withhold taxes on income payments subject to Expanded/Creditable Withholding Taxes.

What is BIR 0619-E?

0619-E. Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded) 0619-F. Monthly Remittance Form for Final Income Taxes Withheld. 0620.

What is BIR form 0619E?

0619-E. Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded) 0619-F. Monthly Remittance Form for Final Income Taxes Withheld. 0620.

What is the purpose of 0619E?

BIR Form 0619-E or Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded) is a remittance form that is used for remittance of expanded withholding taxes, as mentioned within the provisions of Revenue Regulations No. 11-2018.

Who should file BIR form 0619-E?

Who is required to file BIR Form 0619E? Based on the definition of EWT, the entities required to file BIR Form 0619E are withholding agents. As a withholding agent, you're also required to remit the total tax amount to the government.

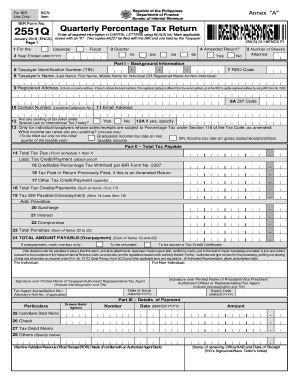

Is 1601e and 0619E the same?

Form 1601EQ – Quarterly Remittance of Creditable Income Tax Withheld. This is what you file every January, April, July, and October. Each form covers the quarter immediately preceding it. It's basically similar to Form 0619E but with more details as to what you withheld.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete bir form 0613 online?

With pdfFiller, you may easily complete and sign 0619e form pdf online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit 0619 e form editable straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing 0619 e form sample right away.

How can I fill out 0619 e excel format on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your 0619 e excel. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is PH BIR Form 0613?

PH BIR Form 0613 is a tax form used in the Philippines for the reporting of the Documentary Stamp Tax (DST) on certain transactions.

Who is required to file PH BIR Form 0613?

Individuals or entities who are involved in transactions subject to the Documentary Stamp Tax are required to file PH BIR Form 0613.

How to fill out PH BIR Form 0613?

To fill out PH BIR Form 0613, you must provide details such as the type of transaction, the date of the transaction, relevant amounts, and other pertinent information required by the Bureau of Internal Revenue (BIR).

What is the purpose of PH BIR Form 0613?

The purpose of PH BIR Form 0613 is to report and remit the Documentary Stamp Tax due on specific legal documents and transactions to the Bureau of Internal Revenue.

What information must be reported on PH BIR Form 0613?

Information that must be reported on PH BIR Form 0613 includes the transaction type, date, assessment of tax due, taxpayer information, and payment details.

Fill out your PH BIR Form 0613 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 0619 E Download is not the form you're looking for?Search for another form here.

Keywords relevant to 0619e form download

Related to 1619e bir form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.